June Newsletter

June 27, 2025

The Property Management Pulse

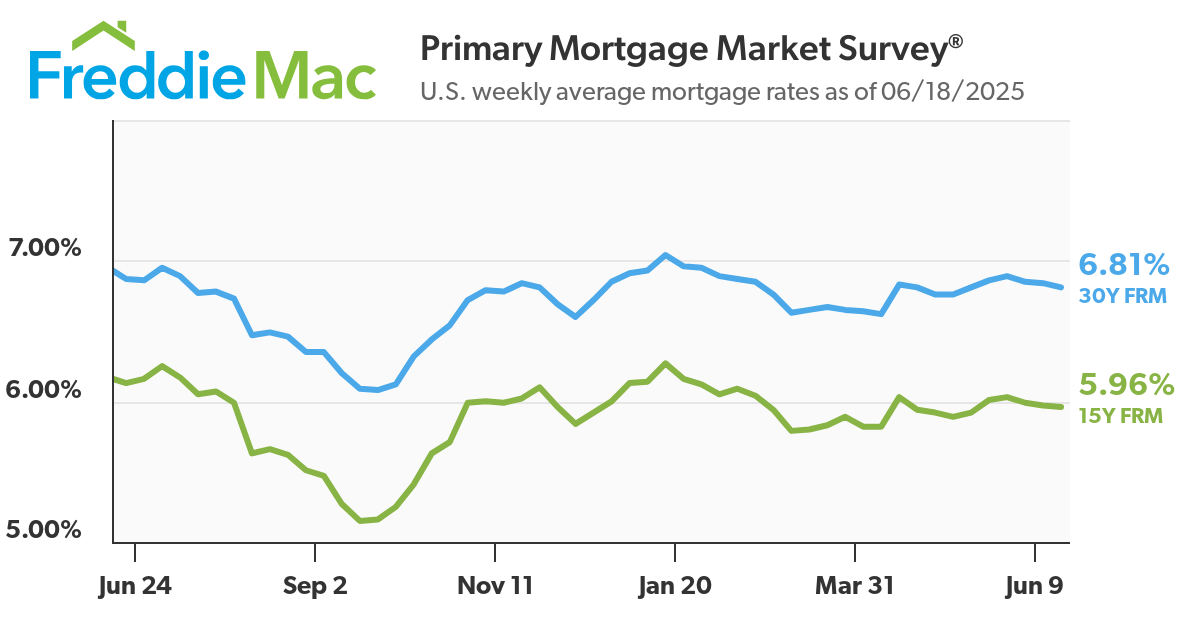

Despite pressure from President Trump, the U.S. Federal Reserve decided to keep the interest rates unchanged in the range of 4.25% to 4.5%, which is where it has remained since December 2024. This means that mortgage rates — which have been hovering just below 7% — will likely not decrease in the near future, which doesn’t bode well for aspiring homebuyers who were banking on it.

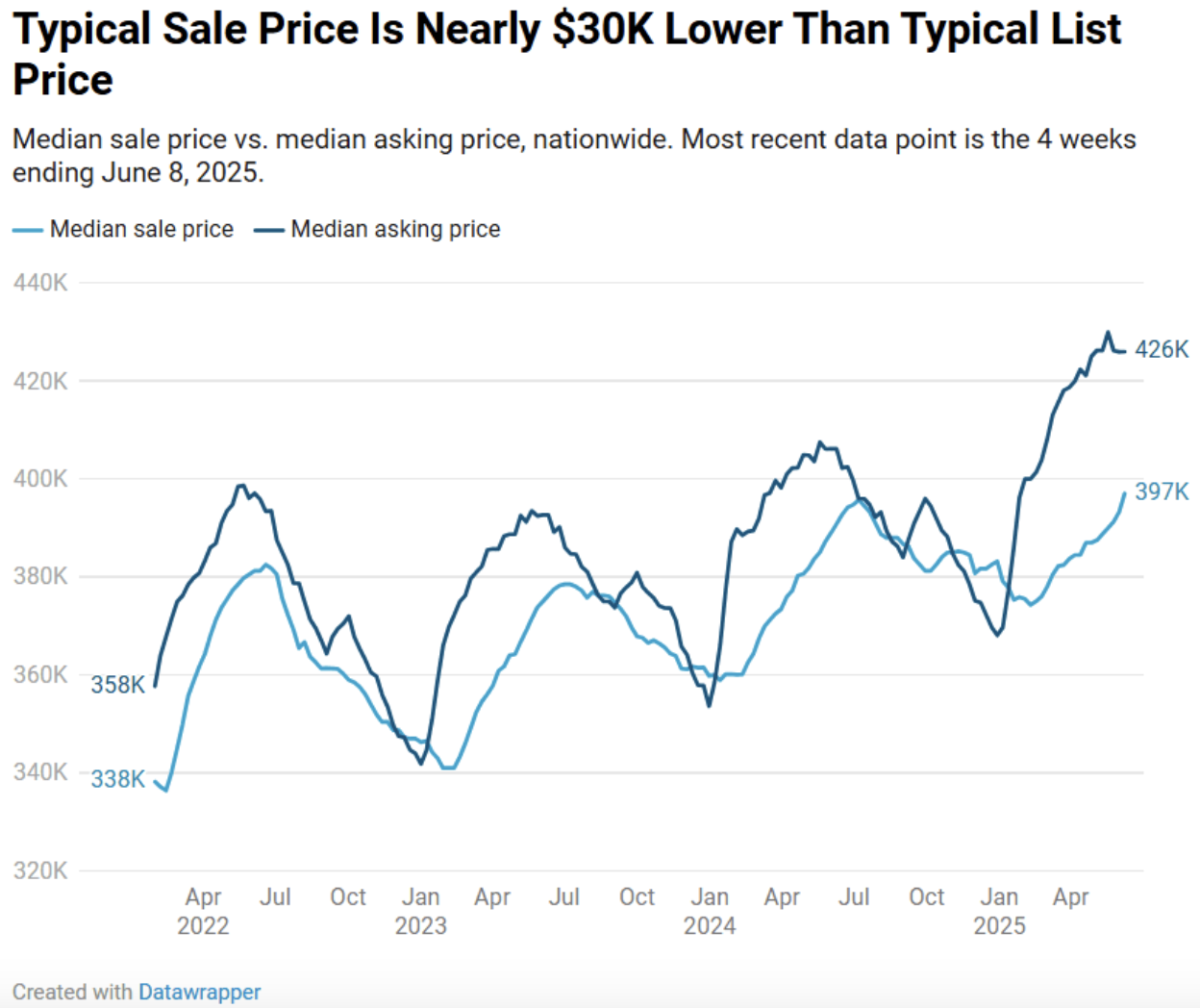

On the other hand, home sale prices continue to steadily rise , hitting an all-time high of $396,500, even though sellers outnumber the buyers in the current housing market. Housing inventory also continues to go up, with the total listings up by 14.5%. But, buyers’ sentiments remain very low, putting a lid on home sales and keeping the housing market subdued.

New home constructions fell to a five-year low , mostly because of buyers’ softened sentiments. Asking rents also fell in 28 major metro cities due to a mismatch between supply and demand in vacant homes. Overall, renters and buyers seem to have the upper hand right now, although the affordability crisis is pushing more and more people towards renting rather than buying.

📊 The Hemlane Brief

Must know data at a glance.

The Fed’s Steady Rates Keep Mortgages High

The Fed’s decision to hold the interest rates steady for the fourth time in a row comes in the wake of economic uncertainty and tariff turmoils. According to Federal Reserve Chair Jerome Powell , this decision was because the bank was “braced for prices to rise more quickly in the months ahead as firms start to pass on the cost of the import taxes to their customers.”

Though mortgage rates saw a four-week low as reported by Freddie Mac , they’re still hovering just below a high 7%. The Fed’s decision means there’s unlikely to be any relief from this. Aspiring homebuyers seem to be aware of this as the number of mortgage applications fell by 3% compared to last week. The median monthly housing payment is also just $53 short of its record high of $2,807 in the week ending on March 23, 2025, as Redfin reported, further tightening the purses of buyers.

Source: Freddie Mac

Matt Schoppner , senior economist at U.S. Bank, said that “Rates are lower than at their peak, but it may not be enough to move the needle in terms of buyer activity immediately.” He predicted that, eventually, buyers and sellers will adjust themselves to these new home loan rates, after which activity might pick up again. But, for now, the elevated interest rates are here to stay.

However, the majority of the Fed officials predicted at least one rate cut in 2025, which might mean there is still hope for decreased home loan rates in the future. But, according to Redfin , rate cuts probably won’t be entertained till we can assess the full extent of the impact of the tariffs on the labor market and inflation — something that could take months. We could even be

Waning Interest Signals a Subdued Housing Market

Spring, which is typically a hot season for the real estate market, was off to a sputtering start. And it seems like the trend is continuing as inventories rise and pending home sales fall.

As per Redfin's data , home sellers outnumber homebuyers by 34% — something that has historically never happened according to records dating back to 2013. Last year, there were only 6.5% more sellers in the market compared to buyers. And in the year before that? Buyers took the lead!

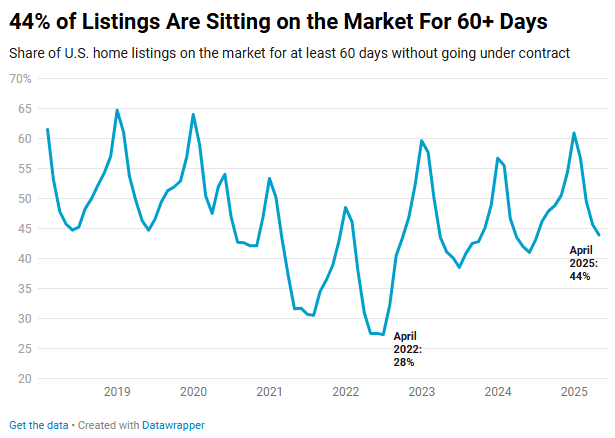

But, this hasn’t stopped sellers from trying to get a piece of the pie. Currently, new home listings are up 4.4% year-over-year, with a whopping total of $698 billion worth of homes for sale in what is the highest dollar amount ever. This number is up 20.3% from last year. Homes are also sitting stale on the market for longer, with 44% of the listings (worth $331 billion) going unsold for more than 60 days.

You would think that high inventory coupled with low demand would push the prices down. On the contrary, home prices rose to a record high, with the median asking price being $422,238. But, the median selling price was 6% lower at $396,500, indicating that buyers have more negotiating power and that sellers are willing to make concessions.

Another indicator of a cooling market is that the typical homebuyer’s down payment fell for the first time in nearly 2 years — likely due to a mixture of waning interest in homebuying, along with the fact that nearly 1 in 3 buyers are making all-cash payments. Realtor.com reported that zombie foreclosures, i.e., the foreclosure of homes that have been abandoned by the owners, are also up, indicating “an unhealthy housing market and economy.”

If supply keeps outpacing demand, Redfin predicts that we may see home prices fall later in the year. Redfin premier agent, Kelly Connelly, advises sellers to be strategic when pricing their homes and not to overprice them unless the properties are in a desirable location and in perfect condition.

Home Constructions Stall as Builders’ Sentiments Dip

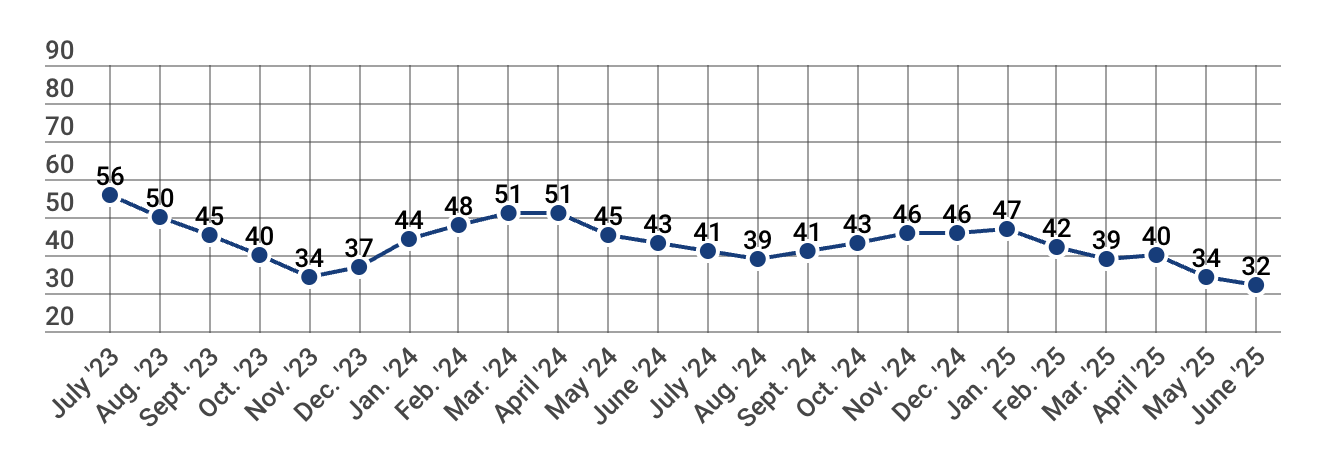

As buyers pull back from the housing market, home builders are being forced to slash prices, leading to a dip in their confidence. According to the Housing Market Index by the National Association of Home Builders (NAHB), builder confidence fell by two points in June, sitting at a low of 32. For context, any value below 50 is considered very negative.

There have only been two other readings lower than this since the Great Recession of 2012, highlighting the severity of the situation.

These data points forecast a decline in single-family starts, says the NABH. Keeping in line with this prediction, housing permits declined by 1% year-over-year in May, marking the fifth consecutive fall. The number of new homes completed in May also saw a drop of 5.4% from the month before. Realtor.com’s Chief Economist Danielle Hale told Newsweek that both permits and starts dropped to five-year lows in May.

In addition to the softening demand from buyers, labor shortages as well as the effects of Trump’s tariffs also play a crucial role in this change. Construction costs have already increased with more spikes being predicted for the upcoming months when the full effects of the 50% tariffs on aluminum and steel hit . "It is likely that contractors will be hit with substantial additional price increases shortly, unless the tariffs are postponed or rolled back,” said Ken Simonson, Chief Economist at the Associated General Contractors of America.

As for what this means for the real estate market, it’s very likely that construction will decrease, with fewer new homes coming for sale. However, more and more builders are cutting prices and offering incentives, which could be a good thing for buyers, says Hale.

Indeed, Lennar, the second largest homebuilder in the U.S., has reported an 8.6% year-over-year decline in their average home sale prices. According to the homebuilder, this strategy of price cuts and mortgage rate buydowns is what will put them ahead of the curve and bring buyers back into the game. And it seems to be working, as they delivered a record number of homes in 2025.

Nick Gerli, CEO and founder of the Reventure App, even said that Lennar is “showing the rest of the market what needs to happen to bring buyers back from the sidelines.” If other builders follow Lennar’s lead, we may see more homes becoming affordable for buyers in the months ahead.

Number of Renters Increase As Lack of Affordability Stunts the Market

According to data from John Burns Research and Consulting, buying a home is now 43% more expensive than renting one! Years ago, the price of buying a starter home was just $233 more than renting one. But, in 2024, that number rose exponentially to $1,000.

Today? An average mortgage payment costs 38% more than rent, as found by a recent study conducted by Bankrate . With more and more aspiring buyers being priced out of the market, many are turning toward renting homes instead of buying them.

Insights from Point2homes , a rental research company, show that renters outnumber homeowners in a majority of suburbs. In addition to being more affordable, rentals offer flexibility to downsize, upsize, or relocate — all without the burden of property taxes, mortgages, or maintenance responsibilities.

Hemlane News:

The Hidden Wealth Strategy

That Most Investors Ignore

On this episode of The Hemlane Hustle, real estate expert Jason Hartman shares game-changing strategies that the top 1% of investors use to grow their wealth—no matter what the market does.

Need help pricing your rental?

Our free rental calculator helps you find the ideal rent for your property based on location, features, and market trends — so you can stay competitive and maximize income.

Looking Forward

With the housing market in deep trouble, it’s unclear what the future will bring. But one thing is for certain: homebuying demand is unlikely to increase until the economy stabilizes and affordability improves.

Get the Latest in Real Estate & Property Management!

I consent to receiving news, emails, and related marketing communications. I have read and agree with the privacy policy.